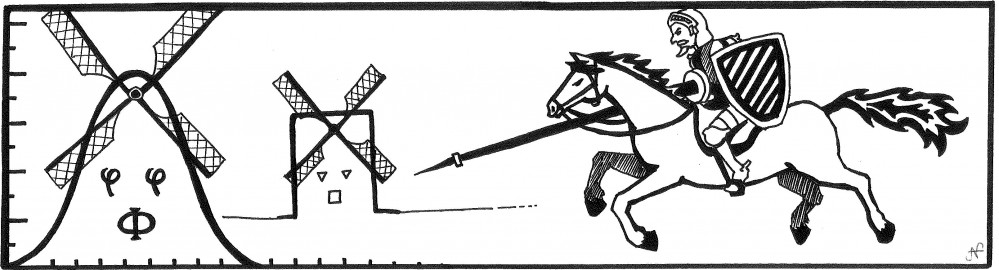

INTRODUCTION: AN EPIDEMIC OF QUIXOTISM

Tony is smart, curious and eager to learn, but his many classroom interruptions with silly comments drive his teachers to despair.

Tony: What do you mean, Mrs. White, assume air resistance is equal to zero? Air resistance is obviously not equal to zero! If air resistance were zero, there would be no point in having parachutes on an airplane, would there?

Mrs. White: Of course Tony, there can be many forces acting on a falling object, but the point of this example is to focus on gravity first. As soon as we’ve got a solid grasp of what gravity is and how it affects falling bodies, we can move on to more realistic examples. We must learn to walk before we can run, you see?

Tony: No I don’t see! I already know how to run! Besides, I thought this was physics class, not physical education!

Mrs. White: (sighs) That was a metaphor, Tony. It means that –

Tony: Metaphor shmetaphor! You just won’t admit you’re teaching us bogus science! Your fancy mathematical equations are just there to dazzle us! But they are totally out of touch with reality!!

Maybe it’s not mathematics that is out of touch with reality; maybe it’s Tony who’s out of touch with real mathematics? Misguided criticisms against quantitative science are probably as old as quantitative science itself, but of late it is most notably quantitative finance that’s become a popular target for verbal abuse. The Great Financial Crisis (GFC) is said to have been caused by quants – mathematically trained PhDs employed by the finance industry – who put too much trust in flawed mathematics. (Other culprits are shorters, speculators, greed, hubris and US president Obama whose mind is controlled by aliens on an illegal planet – I may have a few details wrong about the last one). Simple explanations are essential to sensational stories, but they are seldom conducive to a productive debate.

Even before the onset of the GFC, math-averse critics were receiving a strong boost from a small number of insiders; active or former traders, risk managers or finance professors publishing popular books and articles exposing standard financial theory as moronic, even dangerous. Their writings have spurred similar work by outsiders; mostly reporters and popular non-fiction writers whose familiarity with financial theories is limited to second-hand accounts, very often from the same insiders. By the way, I’m not implying that outsiders are automatically disqualified from the debate. Some, like sociologist Donald MacKenzie (his “An Engine Not a Camera – How Financial Models Shape Markets”, MIT Press 2008, is a must-read!) go to extraordinary lengths to sort out the facts and back up their claims with verifiable references, rather than insinuations and hackneyed stereotypes. Others, unfortunately, content themselves with a blind reliance on the incendiary tracts from a few renegades, while wilfully ignoring more realistic and dispassionate accounts of the way quants work and think.

The result: a barrage of innuendo and wild accusations, with hyperbole culminating in book and article titles such as “The Formula That Killed Wall Street”1; “The Quants: How a New Breed of Math Whizzes Conquered Wall Street and Nearly Destroyed It”2; “The mathematical equation that caused the banks to crash”3, or “The Number That Killed Us”4. The front cover of that last book shows a handgun-shaped pattern of mathematical symbols, to leave nothing to the imagination. Interestingly, the writers do not necessarily agree on which explosive formula or number is responsible for the wave of death and destruction. The Gaussian copula killed Wall Street. The Black-Scholes equation caused the banks to crash, but VaR (Value-at-Risk) killed us. (Speaking about myself, I’m alive and well, thank you.)

The recipe of acting like an iconoclastic hero before a popular audience, heaping scorn on academic establishment, turns out to be a huge success in terms of book sales. From a return-on-investment point of view, the success must be bigger still, considering the minimal amount of thought or genuine research that went in the books. In this 5-part series of articles I will argue that the critics, both insiders and outsiders, have been knocking down straw men. Their picture of financial theory is a grotesque caricature. Their allegations against quants hold no ground. Their math-phobia is based on nothing but prejudice and misconceptions. If you strip away the non sequiturs, half-truths and outright fabrications from their arguments, all that remains is the so-manieth variation on the old joke of the statisticians who drowned in a lake that was on average four feet deep. Except, it’s no longer meant as a joke.

If you’re looking for patient zero in this epidemic of quixotism, Nassim Nicholas Taleb is a good place to start. A best-selling author (Fooled by Randomness, The Black Swan), Taleb achieved world renown with his crusade against the normal distribution and the statisticians and economists who blindly apply it to everything that involves some degree of uncertainty. Today Taleb is the chief guru of the quant-bashing cult. Much of the more recent work bears his influence and sometimes even his explicit seal of approval. Here I will focus on The Black Swan (2007), a seductive concoction of vacuous truths, philosophical red herrings, strained analogies, personal anecdotes, made-up anecdotes, ample references to literature that make the reader feel very cultured while reading them (or at least, make Taleb feel very cultured while citing them), and diatribes against a broad group of people using suspicious mathematical equations. He uses technical words from mathematical finance and statistics and gives them a whole new meaning, counting on the lack of expertise in most of his readers. More on that later, let’s first start with the philosophical chestnut that inspired Taleb’s coining of ‘The Black Swan’, a highly improbable event with dramatic consequences.

Click here to go to Chapter 1

- “Recipe for Disaster: The Formula That Killed Wall Street, Wired Magazine”, Feb 23 2009 (back)

- Scott Patterson: “The Quants: How a New Breed of Math Whizzes Conquered Wall Street and Nearly Destroyed it”, Random House, 2010 (back)

- “The mathematical equation that caused the banks to crash”, The Observer, Feb 12 2012 (back)

- Pablo Triana: “The Number That Killed Us: A Story of Modern Banking, Flawed Mathematics, and a Big Financial Crisis”, Wiley, 2011 (back)