Donald MackKenzie: An Engine, Not a Camera: How Financial Models Shape Markets (Inside Technology), MIT Press, 2008

(This review can also be read on Amazon.com)

‘[T]he belief that a theory can be tested by the realism of its assumptions independently of the accuracy of its predictions is widespread and the source of much of the perennial criticism of economic theory as unrealistic. Such criticism is largely irrelevant, and, in consequence, most attempts to reform economic theory that it has stimulated have been unsuccessful.’

The quote above is from Milton Friedman’s influential, if not uncontroversial, 1953 essay ‘The Methodology of Positive Economics’. Friedman’s essay is still topical today, perhaps even more than when it was first published 60 years ago. In recent years there’s been a cottage industry of books attacking economists and quants in finance, accusing them of employing theories with suspicious assumptions, even to the point of suggesting that the supposedly ‘false’ theories (and their alleged proponents) are to be held responsible for the worst financial crisis in decades. At the root of that accusation lie a host of misconceptions, fallacies and popular myths surrounding financial theories, their use in universities or financial institutions, and the way financial markets operate.

It takes very little knowledge or effort to spread around myths, especially ones that appeal to strong negative feelings about a particular group of people. It requires a tremendous amount of expertise, hard work and patience to unravel the facts and the fiction in a poisoned debate. Donald MacKenzie set himself a difficult task, but his ‘An Engine, Not a Camera – How Financial Models Shape Markets’ is a remarkable achievement.

MacKenzie interweaves two related narratives in his book: that of the emergence of modern economics and theoretical finance, characterized by an abstruse (to outsiders at least) mathematical formalism; and, on the other hand, that of the dramatic growth in both size and complexity of financial markets, in particular the derivatives market. In that respect he covers similar ground to Peter Bernstein’s ‘Capital Ideas’ (MacKenzie acknowledges his ‘great debt’ to Bernstein in the first chapter). Unlike Bernstein, however, MacKenzie uses the historical accounts as an integral part of the argument for his unifying thesis, namely that financial models played a crucial role in molding financial markets into their current shape (I’ll come back to that in a moment).

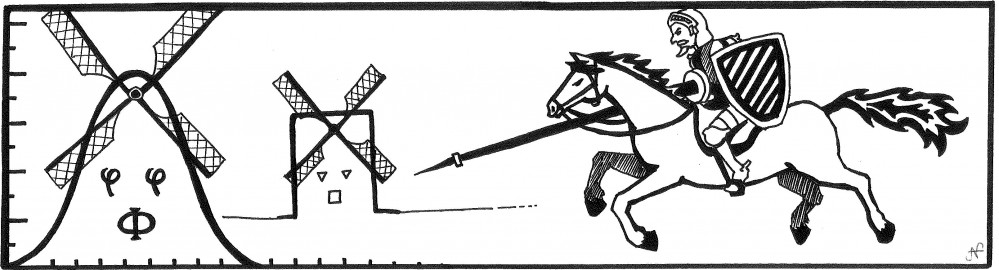

The book title ‘An Engine, Not a Camera’ is a direct reference to Milton Friedman’s essay. As Friedman argued, the point of a model, whether in economics or another area of science, is not to serve as a camera representing reality up to its minute details. Rather, its purpose is to function as an engine – a tool allowing us to make predictions, or to analyze reality. This grounding in its practical use is the very essence and raison d’être of any model. Idealizations, also disparagingly referred to as ‘false assumptions’ (especially in economics), are an inevitable component of any model, not just in economics, but in any science – even physics (frictionless surfaces in physics are the counterpart to finance’s frictionless markets – my own example). Dismissing a model on the basis of the falsehood of one of its assumptions misses the point entirely. Besides, making assumptions does not involve any commitment on the part of the modeler as to its literal truth.

One example to clarify. Black, Scholes and Merton (BSM) made a number of unrealistic assumptions in their option pricing model, for example that trading incurs no cost, or that stock price returns follow a normal distribution (chapter 5 in MacKenzie is a long discussion of the development of the BSM model and its ancestors; as well as its impact on option trading). The limitations of the model are widely recognized (and even pointed out by BSM themselves!), but that didn’t stop the model from quickly gaining popularity. And it remains highly relevant till today. The assumptions can be relaxed, giving rise to extensions of the original model (e.g. options on dividend-bearing stocks). The normal distribution can be used as an ingredient of a distribution that contains fat tails; Merton’s own jump-diffusion model (1976) for example, is a combination of the original BSM (diffusion) model with jumps as an extra ingredient. Jumps are a direct way to reflect discontinuous (suddenly falling) stock prices and the resulting fat-tailed distribution. After the 1987 Wall Street crash, markets found also a more roundabout way to have option prices reflect fat tails, namely through the volatility smile. The metaphor of a model as an engine is very apt in this context: the BSM model was never meant as a true description of reality; rather it’s an engine of analysis, a way of getting a grip on the myriad market forces affecting asset prices. BSM taught us we needn’t know the expected return of the underlying stock in order to agree on a fair price. They taught us volatility is a much more important variable. They taught us the principle of risk-neutral valuation. These things remain valid in more advanced models. And as a very literal application of the ‘engine’ idea: option prices are usually quoted in ‘implied volatility’ by using the BSM formula inversely (i.e. inferring the volatility from the market price rather than plugging in the ‘real’ volatility in the formula).

MacKenzie takes Friedman’s engine analogy one step further. Could it be, he asks, that financial models are more than just tools for the financial modeler? Could it be that they help shape the environment, which (in a narrow view) they are meant to describe? For example, could it be that the Efficient Market Hypothesis (chapters 2,3,4,9) not only inspired the invention of index tracking funds, but actually led to more efficient markets? Or, as an example of an opposite effect: could it be that the assumption of continuously moving stock prices made the markets more sensitive to discontinuities (remember 1987)?

The strongest point about the book is that MacKenzie puts the models into perspective, adds the relevant context and supplies many details in order to avoid misinterpretations, of either the models, or the way they are used. In a lapse of sociological jargon, he calls this ‘the material culture of modeling’. If you find that phrase puzzling, do as me and just read it as ‘modeling in practise’. Practise in a very wide sense; from the models’ historical development to their integration into the daily processes driving financial markets, to the fact that models must obey practical considerations (parameter estimation, tractability, availability of data, etc.) in addition to theoretical ones. It’s precisely those details that are left out by the Talebs, Trianas and Salmons of pop-finance, and that make most of their criticisms totally irrelevant.

MacKenzie never names Nassim Taleb(*), Pablo Triana or Felix Salmon, avoiding direct confrontation with the public heroes. He refers only obliquely to the nastiness of (for example) Taleb’s diatribes as “the coarsening of the debate”. His tone is dispassionate, yet engaging. I think there’s a lot to be said for his sober and factual (even scholarly on occasions) writing style. It enhances his reputation as an author who has no interest in availing himself of dramatized factoids to sell a story. He understands that insults only diminish one’s case. What matters in the end are hard facts and strong arguments, and there are plenty of them in this unique book. When I use the word ‘unique’ I mean it quite literally, for I’m not aware of any other book that matches its depth, rigor and persuasiveness. Even though there are some tedious fragments in the book, at no point did I get the feeling I was reading a textbook. Quite the contrary: his accounts of the October 1987 Wall Street crash (chapters 1 and 7) and the demise of the LTCM hedge fund (chapter 8) are lively and compelling.

Another strong point, as just mentioned, is his rigor. For someone who’s not a finance professor or professional quant, this is quite an impressive feat. MacKenzie appears completely at ease even on highly technical subjects (e.g. Lévy distributions). In this book of nearly 300 pages, I couldn’t spot a single oversimplification or misunderstanding on his part, let alone glaring error. Better yet, I was familiar with the technical definition of a ‘complete’ market (a market in which you can always find a combination of trades to hedge your position), but I never understood why people call it ‘complete’ until I read MacKenzie’s explanation (in a complete market the traded securities “span all possible outcomes”).

MacKenzie put a tremendous amount of effort into this book, and it shows. Much of it is based on personal interviews he had with the protagonists in the years 1999-2004. To some reviewers that’s a weakness, because information provided by interviewees is less reliable, especially if it involves situations where their reputation is questioned. MacKenzie recognizes the disadvantages, however, that’s why he ‘cross-checked’ interviews against one another. Secondly, many details can be easily checked by reading the literature. Thirdly, some accounts (e.g. of the LTCM debacle) were checked for their consistency with price movements in the market. And finally, MacKenzie maintains a healthy skepticism towards exculpatory claims that are difficult to verify.

The rigor is also in the logic and lucidity of his arguments. MacKenzie considers alternative hypotheses, weighs the evidence of competing explanations (was the LTCM debacle the result of a flight to quality, or of a ‘Superportfolio’ phenomenon?), and resists any temptation to draw premature conclusions. He presents his conclusions tentatively and never lets them surpass the evidence. Briefly, it’s a book that reads like an (admittedly, sometimes difficult) novel, but which follows a high scientific standard, usually found only in top scientific papers. For the readers who like slogans: ‘Genuine inquiry trumps pseudofinance’ might be a good one in praise of this book.

If there’s going to be a new edition of this book, I hope MacKenzie adds an extra chapter on ‘The Formula That Is Said To Have Killed Wall Street’. In fact, he already wrote it (with Taylor Spears as co-author): their 2012 article ‘The Gaussian Copula and the Material Cultures of Modelling’ can be found on the web.

(*) MacKenzie interviewed Nassim Taleb, and he quotes him in a neutral context, namely as an anecdote of a trader’s personal experiences of the 1987 crisis (chapter 7).